Investing in Your Future: Strategies for Success

Investing is not just about putting your money into stocks, bonds, or real estate; it’s about taking control of your financial future and ensuring that you build wealth over time. Whether you are starting your first job, planning for retirement, or looking to grow your assets, understanding the fundamental principles of investing can significantly impact your financial well-being. This article delves into effective strategies for successful investing that can help you secure your financial future.

Understanding the Importance of Investing

At its core, investing is a forward-looking financial decision. Unlike saving, which typically involves setting aside money for immediate needs, investing requires a long-term perspective. The primary goal of investing is to create wealth through the appreciation of assets, passive income generation, and capital growth.

Why is investing essential? The answer lies in the concept of inflation. Over time, the purchasing power of money diminishes due to inflation. Without investing, the value of your savings can erode, making it critical to seek growth opportunities that outpace inflation. Moreover, investing can provide financial freedom, allowing you the means to live comfortably, pursue passions, and enjoy life without financial stress.

Setting Investment Goals

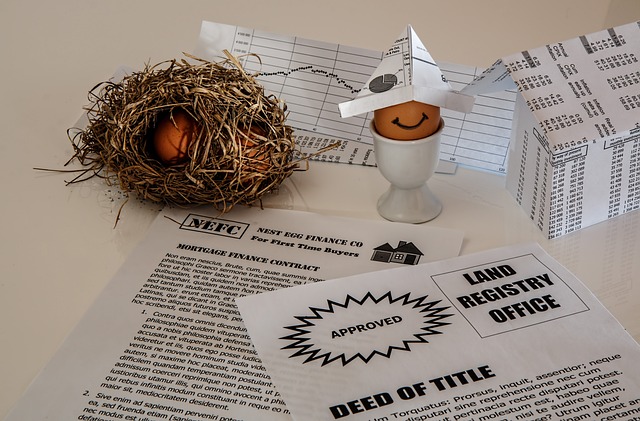

Before diving into the world of investing, it’s vital to set clear and achievable investment goals. Consider what you are investing for—whether it’s retirement, buying a home, funding education, or building a nest egg. Your goals should dictate your investment strategy.

Establish your time horizon: Short-term goals may call for more conservative investments, while long-term goals might allow for a more aggressive approach. Also, determine your risk tolerance—your ability to withstand market volatility without losing sleep. Knowing these factors will help you tailor your investment strategy effectively.

Diversification: The Key to Mitigating Risk

Diversification is a vital principle in investment strategy that aims to reduce risk. By spreading your investments across various asset classes—such as stocks, bonds, real estate, and mutual funds—you can mitigate the risk associated with any single investment. A diversified portfolio tends to be less volatile and offers more consistent returns over time.

The rationale behind diversification stems from the idea that different asset classes perform well at different times. While stocks may soar during an economic boom, bonds may provide stability during market downturns. A well-balanced portfolio, therefore, can provide more steady growth and protect against unexpected losses.

Understanding Different Investment Vehicles

When investing, familiarizing yourself with various investment vehicles is crucial. Each option has its unique characteristics, benefits, and risks. Here are some commonly utilized investment vehicles:

Stocks: Ownership in companies that can lead to capital appreciation. Stocks can be volatile and may fluctuate widely in value, depending on market conditions and company performance.

Bonds: Debt instruments that represent a loan made by an investor to a borrower. Bonds tend to be less risky than stocks and provide fixed interest payments.

Mutual Funds: Pooled investment vehicles managed by professionals. They provide instant diversification and can cater to different risk profiles, depending on the fund’s objectives.

Exchange-Traded Funds (ETFs): Similar to mutual funds but traded like individual stocks. They tend to have lower fees and offer diversification across various sectors.

Real Estate: Investing in properties for rental income or appreciation. Real estate can be an effective hedge against inflation and offers opportunities for passive income.

Building a Portfolio for Growth

Constructing a portfolio requires careful consideration of your investment goals, risk tolerance, and investment timeline. As you build your portfolio, consider the following principles:

Focus on asset allocation, which involves determining the percentage of your portfolio to allocate to each asset class. A common rule of thumb is to subtract your age from 100 to find out the percentage of stocks to hold, with the remainder in more conservative investments like bonds. For example, a 30-year-old might consider holding 70% in stocks and 30% in bonds.

Rebalance your portfolio periodically to maintain your desired asset allocation. This process involves selling high-performing assets and buying underperforming ones to keep your strategy aligned with your goals. Regular reviews ensure that you stay responsive to market changes and your evolving needs.

The Power of Compound Interest

One of the most powerful concepts in investing is compound interest. Compound interest refers to the process where the interest earned on an investment is reinvested to generate more earnings over time. This creates a snowball effect where your money grows exponentially rather than linearly.

The earlier you start investing, the more you can take advantage of compound interest. Even small contributions can grow significantly over time, making consistent investing crucial. For instance, investing $1,000 at an average annual return of 7% can turn into over $7,600 in 30 years, showcasing how powerful compounding can be.

Staying Informed and Educated

The investment landscape is continuously evolving, and staying informed is vital to successful investing. Read financial news, follow market trends, and consider enrolling in investment courses to sharpen your knowledge. Understanding economic indicators, market cycles, and global events can empower you to make informed investment decisions.

Furthermore, consider engaging with investment communities, seeking advice from seasoned investors, or consulting financial advisors. While self-education is crucial, having professional guidance can clarify complex investment scenarios and provide personalized strategies tailored to your situation.

Managing Emotions and Behavioral Biases

Investing is as much about mindset as it is about strategy. Emotional decision-making and behavioral biases can lead investors astray. Fear, greed, and overconfidence can create a turbulent investing environment where poor choices become the norm.

Recognizing these biases is crucial to maintaining a steady hand during market fluctuations. Stick to your investment strategy, focus on your long-term goals, and avoid making impulsive decisions based on short-term market movements. Developing discipline and emotional resilience is essential for successful investing.

The Role of Technology in Modern Investing

With technological advancements, investing today is more accessible compared to previous generations. Online trading platforms, robo-advisors, and investment apps have democratized finance, allowing individuals to invest with minimal barriers and lower costs.

Take advantage of these tools to enhance your investment experience. Robo-advisors can help automate your investment strategy, providing tailored portfolios based on your risk profile and goals. Additionally, various apps offer valuable insights, analytics, and educational resources at your fingertips, making the process more user-friendly.

Conclusion: Investing as a Life Skill

Investing is a vital life skill that can have profound effects on your financial future. By taking a strategic approach, learning about different investment vehicles, and making informed decisions, you can build a robust portfolio that aligns with your goals. Remember, the journey of investing is not just about wealth accumulation; it’s about achieving your dreams and securing a brighter, more prosperous future.

As you embark on your investment journey, remain patient and committed. Success in investing often comes from a long-term perspective—an understanding that financial markets can fluctuate, but a well-thought-out strategy will yield rewards over time. Take the time to invest in your financial education, stay informed, and adapt to changing conditions. Your future self will thank you for it.